0755-88364420

大优势

— 专注于研发、生产、销售视频监控领域的高清智能产品

大优势

— 专注于研发、生产、销售视频监控领域的高清智能产品

公司历程

11年专注智慧社区+智能家居研发

行业优质企业供应商。

安防企业厂商。

品质优势

建立严谨的生产流程,产品质量工业级标准直接供货。

自有品牌,自有知识产权。

11年数字产品研发、生产销售于一体的高新技术企业。

服务优势

质保承诺:2年质保,终身维护。

产品检测:公安部权威机构检测认证。

退换货处理:不满意产品无条件退换。

产品性能优势

智能指纹锁,独特外观设计:自主研发团队。

获国家多项技术zhuanli,新一代内置模块,使用更持久。

访客实时可视对讲,可添加防盗报警功能;更放心、更安全。

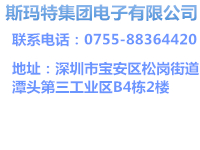

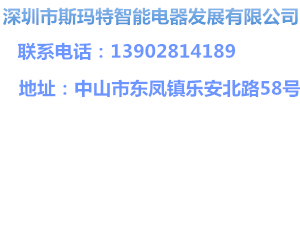

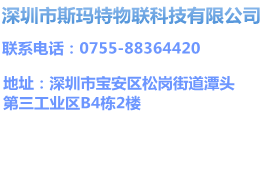

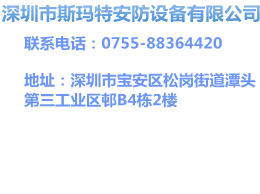

欧洲杯开户平台旗下子公司

SUBSIDIARIES

欧洲杯开户平台旗下子公司

SUBSIDIARIES